Monthly Digest | December 2020

- Against All Odds Research

- Dec 30, 2020

- 17 min read

Analyzing the key trends, events, and factors that drove market behavior in December 2020. Let's explore the pages of December 2020's trading chronicle together, unlocking the secrets that unfolded in the realm of stocks and investments.

December 01 2020

2 things to be said about this

One and this is the most important. There is 272736272627252735386 things to trade. Thinking in all stocks, gold, ag, bonds, crypto is a waste

Most of the time when commodity cycles are trending they will flow back to the lagging commodity class

This seemed like a sentiment washout. I’ll continue to hold my crypto positions because bitcoin could pass 20k and never look back, But to go all in when we have a lot of great values out here...

Sentiment wash out. I’ll be paying attention and looking for our buy signals in the miners this week

Tips and gold major divergence

Gold and real yields inverted

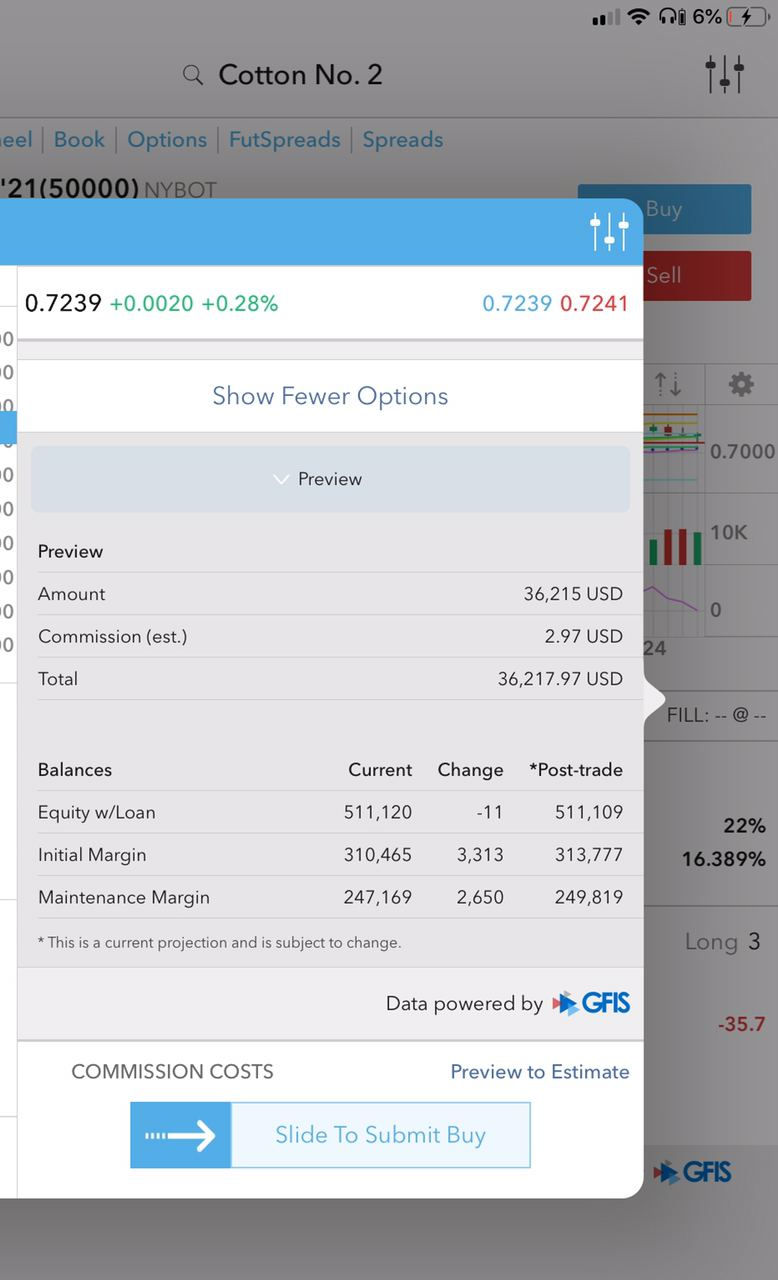

Yields 30-40%less than expected. Ice storm also hurt more than people realized. Farmers are going to sell this crop cheap sadly. Cotton

NYAD at a new high today. Lets see where it closes

There was this terrible song that use to play at the bike park when we were kids. It said something like beauty in the breakdown. Finally I get it

The dollar breaking down

Because we bought X... am I now a value investor.

Silver up almost 7% today. It looks like a bottom. And we all know I’m an ass man so we like bottoms in here. But it also might not be a bottom. Anyone remember the story with the girl I called “tricking” with the 4 bra’s

Tricks can happen that also make bottoms 👀 💯

But then you pull everything off and you are left with... nothing.

I have some news and the market has been saying it all along. We will have a vaccine soon and it will be public by early next year. At least 7 of them

December 02 2020

What was the best part of the gold move today. Bonds went the opposite way. We need that correlation to break down

What if I said I know bitcoin will hit 37k. Will it look like I know some shit - I don’t. That is the projected move though. Night all lol

First week of December is famously known for tax loss selling. Prepare for turbulence in the short term

Oil bouncing off of its break out zone.

Cotton may look large but it’s not very volatile. Sugar put in a major reversal today

Turn around Tuesday

A mistake I made earlier this year was being too bearish in April. I said I would not make that same mistake again. If the right opportunity presents itself. As short term traders the best we get sometime is when everything links up well for a trade. Heavy short interest. Oversold to long term support levels. Election catalyst. Strong seasonality. Hated rally.

All of this made november a good month.

Look for natural gas to make a higher low right here. Stop at the November low.

December 03 2020

On price action and 3 push rule

New high for inflation expectations

On Futures

Amzn continues to consolidate but if it gets going it’s not going to stop

December 04 2020

Added a new one for diversification this month. Canola

Cotton. We have been talking about the fundamentals this month. But when to buy?

Soon. Very soon

Platinum broke out. Don’t be afraid to buy strength

Platinum was the first mover weeks ago. It’s continued to outperform ever since. Holding from the flag break out. I guess you can’t call that a flag. Long from the ugly base thing lol

Speaking of 39 inches

Rotations, pull backs and new leaders. Nice flag break out in small caps today

Strong Friday’s can lead to strong Monday’s

OIH put in one hell of a week. 7.26% up on the day

December 05 2020

Something that the bears aren’t saying

I don’t see a ton of sell off potential to the end of the year. Actually I could easily see us rallying to 4000 by year end or near it. (I hate even numbers) if the potential for the market was dulled down because of covid. Then why wouldn’t it open up?

Fundamentally I see this rally as artificial but anyone would say that. It does not matter. Inflation expectations continue to move higher. One day that will be very bad for the market but right now we are in melt up mode

Positioning on a longer horizon isn’t extreme. Some systematic funds could be adding new index’s. IE energy, small caps, banks as well as Asian and European index’s

The dollar is fucked. That’s the technical term. Unless we have a black swan. We are in a low risk market. The only risk is, risk is low.

This usually leads to a melt up

Here’s the Soros story I talked about last week

Implementation and flexibility. You need to implement a trade in a way that limits your losses when you are wrong, and you also need to be able to recognize when a trade is wrong. George Soros has the least regret of anyone I have ever met. Even though he will sometimes play up to his public image as a guru who knows what is going on, it is in no sense what he does as a money manager. He has no emotional attachment to an idea. When a trade is wrong, he will just cut it, move on, and do something else. I remember one time he had this huge FX position. He made something like $250 million on it one day. He was quoted in the financial press talking about the position. It sounded like a major strategic veiw he had. Then the market went the other way, and the position just disappeared. It was gone. He didn’t like the price action, so he got out. He doesn’t let his structural views on how he believes the market will play out get in the way of his trading. That is what strikes me about really good money managers —- they don’t get attached to their ideas.

The main thing we will talk about is the possible next leg in the dollar. CADUSD leading. Good for energy markets.

MXNUSD the wildcard

In the short term it has been the best performer

The yen. The most boring trade in macro.

Asian led economic recovery. Yeah. I still see it

On to dollar sensitive areas. EEM

Metals and Mining. No one wants to pay attention to it but damn we are moving

This thing has been a monster. FCX

EWZ Brazil. Just getting started

We talked about the pull back in the majors in the uranium space to the 200 day MA. This week we closed over the 200 week MA as well. This is a major change in the uranium space

The aussie dollar isnt the only thing thats bullish in that area.

Copper we have been bullish on copper for awhile here. Everyone is saying this move will end soon. As long as the bears are out. This will and can keep moving higher. This environment is a great environment for copper.

oil. And the day I learned stock charts sensors bad words

OIH look at the big picture

Look at the bigger picture

Follow the price action

OVX oil volatility falling hard

sugar short term.

natty. Fucking natty

JNK TLT a broke ass credit spread chart

I am still short the long bond. I think this is when this party really gets started.

30 year yield green and copper to gold ratio in white

small cap AD line at a new high!

Bull bear indicator

silver to gold in elders bars. Gold in white

December 06 2020

c

One thing I want to bring up here. So I mentioned that unless we saw consolidation. Bitcoin would be a grede C breakout. Meaning Ill stay long but I wouldnt be interested in buying the break out

Right now we are consolidating and building to a move higher. This would be a grade B break out. Much better

December 07 2020

Yen long term

Someone said that that isn’t significant. 512 points in the dow

Umm that was 1998 the Dow was 8000. The Dow’s over 30000 today

My main trading platform is on IB and it’s down this morning. Yay. Break time

Melt up. And up

Ags are perking up nicely. This is exactly why I really enjoy trading a diverse group. Equities can get hit but commodities can rise. Bonds can move. Currencies can move. Crypto can move. Energy can move and so on...

You’ll never know where your biggest winners will come from.

December 08 2020

Traders almanac

Small-cap stocks tend to outperform big caps in January. Known as the “January Effect,” the tendency is clearly revealed by the graph below. Forty years of daily data for the Russell 2000 index of smaller companies are divided by the Russell 1000 index of largest companies, and then compressed into a single year to show an idealized yearly pattern. When the graph is descending, big blue chips are outperforming smaller companies; when the graph is rising, smaller companies are moving up faster than their larger brethren. In a typical year, the smaller fry stay on the sidelines while the big boys are on the field. Then, around early November, small stocks begin to wake up, and in mid-December they take off. Anticipated year-end dividends, payouts and bonuses could be a factor. Other major moves are quite evident just before Labor Day—possibly because individual investors are back from vacation. Small caps hold the lead through the beginning of June, though the bulk of the move is complete by early March.

Market Value of Global Negative Yielding Debt

Silver outside day up close yesterday from a tight range. Very bullish. Could we break up now?

The ingredients are there. I had a long signal for platinum, then silver, then the silver miners, then the miners. Gold put in a catapult signal Monday morning

I think we are ready

Watch for a reversal higher today. Gotta love Tuesday’s

PFIZER VACCINE FOUND SAFE, NO CONCERNS THAT WOULD PREVENT EMERGENCY USE AUTHORIZATION: FDA

December 09 2020

I’m not a big gap fill person. But on futures bitcoin has a big gap to fill.

Lumber. Does a double top lead me to take profits? No

It is a point to be cautious of.

Turn around Tuesday to a fuck you Wednesday

December 10 2020

Are we seeing a pattern yet. Dollar...

Sensitive

Assets

BTC still bullish

Another ridiculous financial myth - The constant fights between growth vs value

Look inside that value ETF one day. It’s just a group of left for dead stocks. They have even said - They pick growth stocks and then value is what’s leftover

December 11 2020

Dollar dollar bills

Legendary

Adding to the 30 year bond short here

Bitcoin closed its futures gap. Let’s see how it reacts here. Russell already positive

Commodities are having a week. Russell fell. When 39 inching it goes wrong

Wheat is finally moving

NG has a buy signal. If you like torturing yourself

December 12 2020

The first of 7

Significant rainfall deficits

Good for soybean, coffee, sugar prices

Energy dividends much higher than utilities

December 13 2020

1 this week we are going to focus on actual trades

Wheat entered again this week

HE hogs feb. looking for a close over 66 to enter.

CC cocoa. Entered a half position on friday as we closed over the 10 EMA Ill add if we break out of the flag.

Fucking natural gas

Sugar in the buy zone

bond spread trade. Shorting th long end and long the short end

oil still long

Oil targeting 50 still. Bullish

Copper as much as I have enjoyed this position I have to admit that there are some issues. I am still long with a trailing stop at 3.25

as much as everyone keeps talking about stretched dollar positioning... Im not seeing it

2 weeks ago I wrote that we were in the red zone so I wouldnt look for any crazy reversals. We certainly saw a nasty break down. Right now we are in a flag

Weekly in the red zone, all time frames bearish.

BTCUSD both systems bullish. No closes below the bottom of the bband

If santa claus should fail to call, bears may come to broad and wall.

we have just got in to the santa rally part of december

inflation

Small caps on top

Silver to gold ratio

December 14 2020

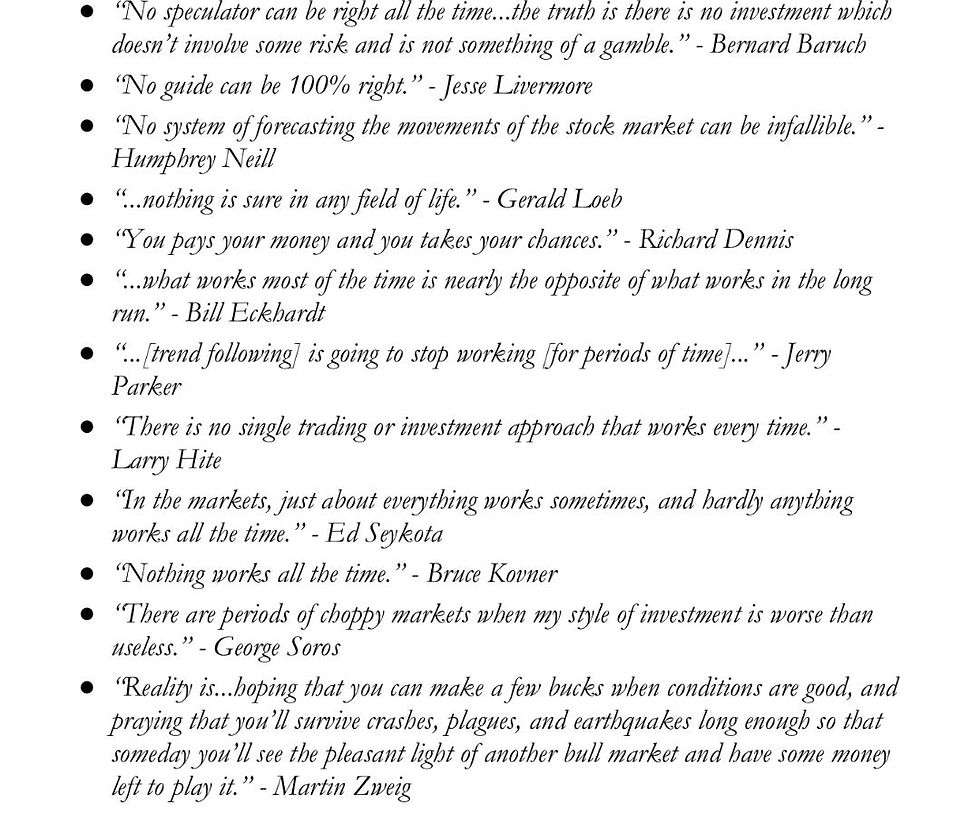

“My financial success stands in stark contrast with my ability to forecast events...in predicting financial markets, my record is less than impressive.”

- George Soros

For you stock pickers - Transports!

Entered hogs this morning

MRNA is most likely the next vaccine to get approval

Silver is in a major squeeze. But some March calls and walk the fuck away. Only use money you can afford to lose easily. But this could be a 5-15x trade ITM. OTM 20x.

Commodities are literally murdering the stock market

Silver. Feb ATM calls are trading at 1.61 In SLV

HL

December 15 2020

In futures I’m in the silver feb monthlies. Aggressive at 25 dollar calls.

Let’s go over buying options allocations really fast. How I set it up is if I have a 100k account I want to use 1% of the account per option trade knowing that it can go to zero

5% would be the most aggressive I would go. If you’re buying some yolo calls in an account you don’t care about. Feel free to do what you’d like. But I personally try to risk 1-3% of the account on a trade. That gap up in bitcoin futures was very strong. It’s gained the energy to break 20 and never look back.

From the weekend we were looking for a great buy point this week. It think it’s here

Short term buy for a swing. Broad stock market.

Our brains make trading really complex and difficult. Which is why an idiot with a plan will outperform the PHDs consistently in this business. Knowing yourself is key

FDA staff endorses emergency use of Moderna’s Covid vaccine in a critical step toward approval - We will have 7 by year end.

That’s an everything day

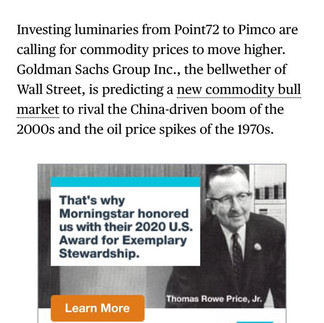

As the ten and 30year commodity cycles come to an end. Commodities are insanely undervalued

Vietnam. Still long Vietnam

My ETF choice for uranium is URNM. I own some of the majors that we have talked about before. CCJ being the main one. You don’t have to buy The Whole sector but I do think it’s important to have uranium exposure.

December 16 2020

Our fixed income allocation is only made up of tips and IVOL now

Gotta diversify

Bitcoin with a beautiful break out today

The ag cycle is getting pushed and pushed. 2021 should have severe weather in both sides. La Niña does not just mean cold. It means extremes

Coffee is on its way

We have a perfect storm in the coffee market. Central America, Vietnam and Brazil are all having extraordinary weather issues. We have been seeing flooding in Vietnam and Central America and we should expect disease to spread that could significantly impair coffee production which would dampen supply coming out of those areas. All while Brazil has had significant dry weather. Of course this all leads to spoilage which means that a lot of coffee can’t even be used. We have NEVER seen the amount of rain that we are seeing in Central America in the last 50 years.

This is why my target is 150

NG still long but I really do see some bring fundamentals here. COT price weather...

Very solid break out today. Anyone who’s using the system to stay long. Give yourself a pay on the back for strong hands

Updates to the charts from last week

What do we need to see now. Celebrating is happening all over. And yes we are long as well and you all know me I love a break out. I upgraded this break out to a buy as well. We have to see this hold.

Yield curve at 3 year high

One thing we have to always admit is what we don’t know.

I’d like to think that I understand the fed action and how it affects the market. But I know that on a fed day. Trying to trade around fed action is pointless. Unless you want whiplash.

Doing my journal today... I realized we haven’t put on one short since September. Every commodity signal is neutral to bullish

Silver calls 78% in 2 days.

December 17 2020

Silver calls doubled. Bitcoin can easily have a throw over here to 25k.

Winners for today

People always talk about gold and silver price and they forget where the alpha is - The miners

10% today around 30% this week. This year has been fucking mental. The most legendary year of trading ever. Biggest crash to the biggest rally. Negative oil to 50 dollar oil. Silver running from 11 to 30

Wheat at a 5 year high

And our favorite monster

I could go on but the point is - 2020 was crazy. I really do not expect anywhere near the same returns next year

You can see the entries during the weekend reports on all of these markets if you want to take the time to dig. I don’t want to social media you guys and say “nailed it” when we didn’t lol.

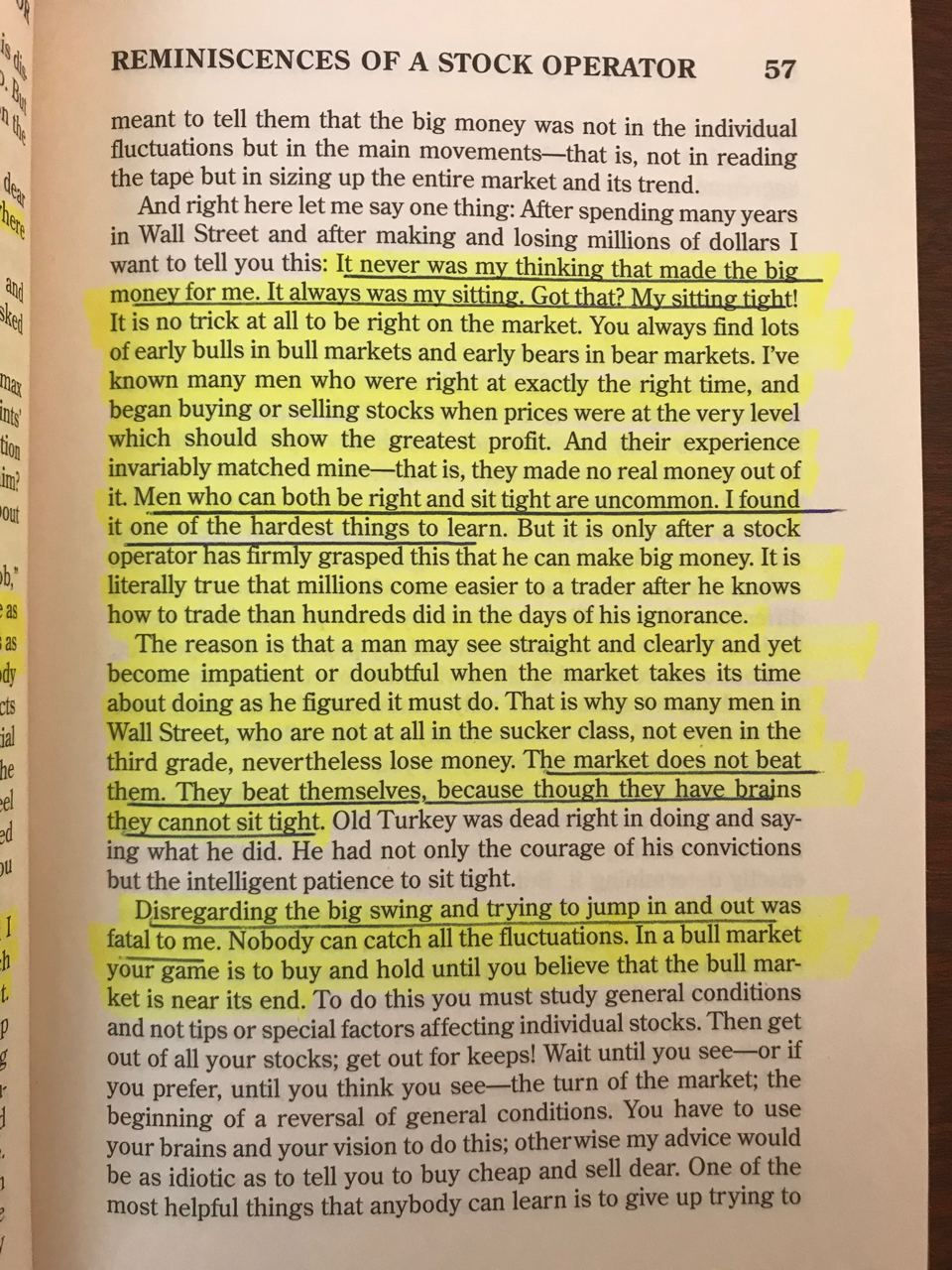

No one gets everything right and certainly not me but we can attempt to get the general flows right. The big money is in the big swing.

Don’t bet against Russia

Stagflation

Got Canola

December 18 2020

Scared money don’t make money and position sizing. People think these are contradictory but they aren’t. You have to have the right position size to NOT be scared to manage the position properly.

Cotton has joined the big dicks only club. 39 inching it

To the question on Bitcoin. All signals are still bullish.. Sentiment signals are stretched so a pull back is possibly but most likely will be short lived. But a pull back is always possible

No reason to trade in and out for ticks

BP gold miners put in a buy signal this week. This shows broad participation.

If you didn’t know today is quad witch. Spy went ex div today as well

This creates volatility.

Still short the long bond and it’s looking for a move down

December 19 2020

You’ll see me use a lot seasonality charts and time cycle lows. It’s not that I’ll just buy in to a bullish seasonal set up.

It’s mainly a caution signal... mainly you probably don’t want to short when we have strong seasonality. April and November for example

Good trading is mainly knowing what not to do. A good way to learn this is by reading Alexander’s elders books and using the elders bar setting on stock charts. Green bars don’t mean buy they mean don’t short. Red bars don’t mean sell, they mean you can’t buy.

For those who understand the gamma flow this has a lot to do with the Tesla inclusion that happened yesterday

Risk management-Rule number one for futures trading. USE STOPS.

Seeing some of my friends get decimated this year has been tough to watch. We all do and have so don’t get me wrong. However if you’ve made it to the next level and you’re trading the professional market you need to realize you’re playing with the pros who know more than you. The big thing separates the traders is risk management. I had a buddy this year who bought oil when it broke to 40. He didn’t use a stop because “it couldn’t go any lower” and a normal 10% stop on the position turned in to a margin call.

Use stops

I’m a big energy bull. Number one coal. I like big oil. I love any of the metals that will be used. Conductors. Cobalt. Water...

Coal, oil, natural gas, ethanol... people have the idea that we can’t easily move past all of these easily.

There will be a lag and our electric cars don’t just run on unicorns and fairy dust. Right now they mainly run on coal.

December 20 2020

How long have we been on the stagflation thesis? Thanks for joining us Bloomberg.

BTC... Yes, all signals still bullish

Gold... we closed in the trend channel on friday.

Silver. Still where we want to be in the precious metals market

this is what we want to see

silver to gold ratio

GDX

Gold against spy white

XLY against XLP

TLT against SPY

KRE against SPY

NYAD line bullish

NYAD common stock volume bullish

since the march lows

SMH dow. Dow theory charts-bullish

Sentiment is stretched. Some hints of weakness in breadth data. For the moment we need to watch for possible weakness developing. Watch copper, oil and KRE. Watch for strength in the bond market.

At the moment the strend is strong and we need to get out of the way and let it run higher.

It’s funny to think about how happy I was that day. Then oil ran to 80. Then 50. Then negative. Now almost back to that price.

December 21 2020

One more thing. With the way the Tesla rebalance would work, I would expect some possible volatility this week.

Silver pushing a 60 day high today. That’s my out of consolidation signal. Let’s see if it sustains

I was looking for volatility today. I’m not sure how the open will look yet obviously but regarding futures. I’d say that this is short lived. Watch the opening 30 min range today. See if we break down hard or if we gap down and reverse.

Bond prices are falling hard. Vix is letting go.

Soybeans 39 inching it

Bitcoin and silver holding steady

Lumber no fucks

My futures account started today down 12% (that I saw and was probably more in the middle of the night.) and is now down 1% on the day

That’s some bullish price action in the trades that we are looking at.

This is looking like a very bullish close for natty here,

Just finished this interview with Patrick.

December 22 2020

Cocoa. Last chance buy. NG and cocoa are both on last chance buy signals actually

Nice follow though

Turn around Tuesday set up

The Russell is already in it

WFC... Actually is a buy. Crazy to hear myself say that.

December 23 2020

The Christmas trade is buying two days before the holiday and holding till next Monday. You can up the profits by holding 5 days after the holiday. In the SPX this has a 88% win rate in 20 years.

Healthy. Uranium killing it.

December 24 2020

Breadth was strong today. The leaders were weak. Not the market

I really despise the phrase priced in. What the fuck does that even mean

Well I do know.

“The price is high, I’m scared”

“If the market is acting right. Don’t be in a hurry to take profits”

Pre holiday volatility is always a thing. Don’t take any US market move today too seriously.

25 December 2020

I’m getting a lot of questions about BABA and China. One I’m still long China. A big part of that is BABA. I’ll get in to that soon. If China wants to be a world leader (they really fucking do) they are not going to crush Alibaba.

Let’s see how yesterday’s voice note on Bitcoin survives the weekend.

This is a little long but it’s a great example and lesson on contrarian trading.

tech leaders are weak. Not tech.

lumber. Only this front month contract has not hit a new high. It will follow soon.

Wheat long term trend, very bullish

GDX to GDXJ

XLE and OIH have new buy set ups

bullish cad

Just got off the phone with a friend who is having an issue. Which I have as well. Close friends who don’t have an understanding of the dangers of investing I won’t touch their money.

If it’s someone that you care about a ton it could hurt your objectivity. Some people don’t have that issue at all. Some do.

One more thing to add in the voice note. We have been talking about the seasonality of gold miners and silver for awhile but we are in the heart of it right now!

This is historically when the move starts. So far the low has held.

We recommend URNM over URA. Better construct.

In the marijuana space we recommend MSOS over MJ.

"First, after a devastatingly brutal and agonizing stretch of losing trades you’ll wonder if you will ever make a winning trade again.

That tests an individual’s grit; does he have the stamina, courage, guts, and smarts to get up and engage the battle again?"

"And second, there will come a point when you begin to ask yourself why it is you make money and if this is truly sustainable.

That is actually scarier because it acknowledges a certain lack of control over anything."

- Paul Tudor Jones

"It was a cathartic experience for me, in the sense that I went to the edge, questioned my very ability as a trader, and decided that I was not going to quit. I was determined to come back and fight."

- PTJ

Paul Tudor Jones lost $10,000 when he was 22, and when he was 25 he lost about $50,000, which was all he had to his name. In February 1981, at 28, Stan Duckenmiller launched Duquesne Capital with $1 million. It was an easy decision because of a consulting arrangement on the side that provided $120,000 in revenues. His fund performed well and assets swelled to $7 million by May 1982. When his consulting client went belly-up, he had an immediate problem. His 1% management fee only generated $70,000. His overhead per year was $180,000. At the time, the firm had assets of just under $50,000. Worried about the firm’s survival, Stan placed a desperate bet. He was convinced that interest rates would fall. He put all of the firm’s capital into T-bill futures. In four days, he lost everything. To keep himself in business, he sold 25% of his company for $150,000.

It’s important to know that I don’t know one trader who had an easy time with it. And no I’m not talking about your friend who opened an account around the March lows when the market had its biggest rally ever.

This is for the people who’ve been doing this fir years. Consistency in the long run is the hardest part of this game.

Everyone’s made mistakes, everyone has lost money, everyone has had rough times and your largest drawdown is always in front of you. With time, dedication and constant brutal honesty. You can get to where you want to go.

Ep. 838: Take Shots with Michael Covel on Trend Following Radio - I’ve always enjoyed this one

On Bloomberg

December 28 2020

The Christmas trade is buying two days before the holiday and holding till next Monday. You can up the profits by holding 5 days after the holiday. In the SPX this has a 88% win rate in 20 years. - Trade one has been solid.

Uranium

December 29 2020

This is starting to feel familiar

Japan leading. The rally isn’t over guys

Im going to do some work today for a different project on the dollar.

Everyone is looking for the dollar to crash bitcoin, gold, silver, stocks, currencies...

I have held the same opinion this entire time since we broke down and right now everyone is looking at the 2018 88 level.

Which also links up with the next major low in gold.

December 30 2020

Since we have been in full pump mode.

AMZN looks like it started a new trend.

Most of the time if you see a band squeeze break out, you want to hold on to the trade...

Home builders have been a major laggard but this is looking constructive... ha

What is the most important factor of any trade? - The trend

Good thread on inflation

December 31 2020

Breadth still making new highs

The futures account closed the year at the best yearly return I’ve ever had. I’ll post the month over month soon. Hope everyone had a great year. Thankful for all of you and the conversations we have had. Staying open and brutally honest is the best way to grow. You all help me do that. I’ll go over 2020 this weekend.

Comments