Monthly Digest | April 2021

- Against All Odds Research

- Apr 29, 2021

- 8 min read

Updated: Jan 11, 2024

Analyzing the key trends, events, and factors that drove market behavior in April 2021. Let's explore the pages of April 2021's trading chronicle together, unlocking the secrets that unfolded in the realm of stocks and investments.

April 01 2021

If you’ve been on here for awhile you know that the first trading days of the month has a bullish leaning

It’s always interesting to look at your currency portfolio and see that the mexican peso is the strongest currency.

It’s been a tough quarter for a lot of people.

It’s always nice to see the Wall Street journal and most of your trades are at the top

Not to mention lean hogs. Literally at the top.

One thing that’s in favor of bonds here.

ISM came out today. Strong number. And bond prices went up when usually they would fall. I’ve made a not of this for myself today

Also we are seeing divergence in the 30 year and 5 year. 5 year made a lower low and the 30 year did not.

Check out the weekly bar on gold. Bullish.

CAD weekly

April 02 2021

Futures portfolio is done for the quarter. We hit a 49% for q1 2021.

Industry futures average is up 2% - Barclay CTA Index

April 04 2021

1. “According to Pay with GasBuddy data, Easter travelers sent Friday US gasoline demand up 4.1% from the prior Friday. Through Friday, gasoline demand this week stands up 2.3% from last week and is cruising easily to a new pandemic high.”

April 05 2021

Reading a new book and this quote jumped out

Brazil Index

Seasonal USDBRL

Sugar Weekly oversold bullish trend signal. Looking for buying opportunities

Sugar, buy alert over 15.26

This is a set up

Commercials buying copper again

20 66.66 is the number to beat

Dollar

22 in the last 35 years the most bearish month for the dollar is

23 30 year bond

25 yields. I am starting to focus on the short end of the curve

"small caps are dead" yeah sure... lol

Platinum

RGLD, FNV... both are buys here. (Long term portfolio)

EURUSD pivot, .382 retracement, reversal pattern.

AUDUSD false breakdown

April 06 2021

NYAD new high

SPX and equal weight SPX (RSPZ)

Dow/small caps

Dow/EEM

DOW/TRAN

CRB/USB

GDX/GLD

Lumber

Kospi entered long

ITA defense

BTC still long

Had a talk with Mish yesterday. The first bit of it isn’t formal but I kept it because she had some great points. Got some work to do with my mic and formalities but it’s a start.

If silver closes here. I’ll have a futures signal for a long at the close

Look at the accumulation

If you know what you are doing. This is the environment to buy leaps or long term options in miners or metals

December would be best

September would be the earliest

Calls on GDX SLV GLD if you don’t trade futures

These need to be long term so I would NOT buy them within a two month expiration

For everyone out there who wants to buy bonds. Keep in mind that precious metals should be used as the hedge in portfolios now. Bonds could rise but they certainly will not outperform gold.

April 07 2021

Watch the vix today

Market has been shaky but the vix is falling off of a cliff

Usually leads to some upside

July sugar futures will get a buy signal if we close here... if we dont. I'll ook at it tomorrow.

Sugar, buy alert over 15.26.

Wheat is really trying to hold here

coffee

First choppiness index signal in years.

Major divergence in in the OBV. A buy signal would be above 127.6

The choppiness index... I have never seen readings like this. Lumber is out of control

EWZ (Brazil ETF) went bullish trend today.

Something to pay attention to. That is a nice asending triangle set up.

Stop being placed around 50k - For a short term trader. My system is still long, I point out these short term set ups just to point them out.

April 08 2021

Brazil is new.

Weights

With the way the chart looks on the SPX. I’d look for a major move (probabilities point to higher) on Thursday or Friday.

I’ll be talking with Trader Vic sometime soon

When a commodity is moving you want to see the one year spread confirming (CT July 21 CT July 22)

The spread itself looks great and it is a good way of putting on this trade

This could be an interesting time for KC wheat. Most likely this is when we start to see reversion

USD

In the last month... check out brazil and mexico.

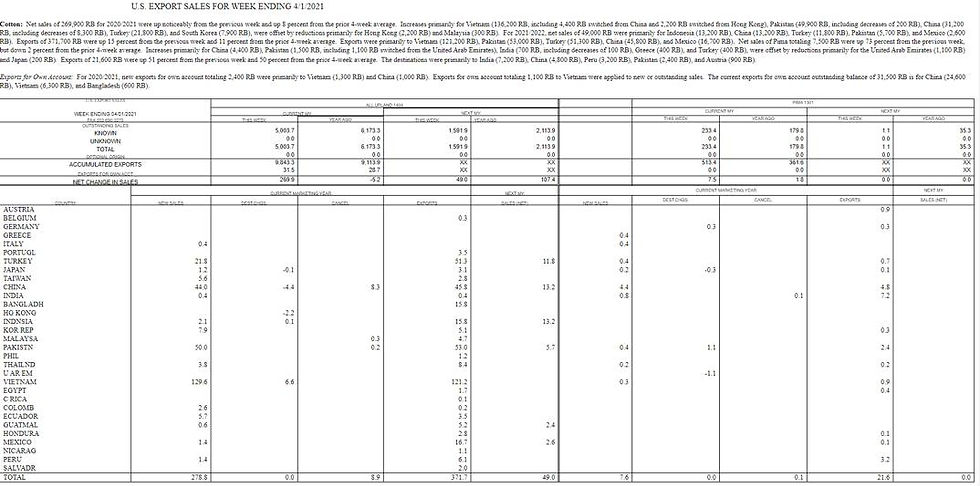

Cotton USA sales

I keep hearing how short speculators are (green line) on bonds right now. However the position has only gotten smaller since November.

April 09 2021

Futures, one year performance.

Broad indicators look good. The NAZ however has divergence but that. can always be resolved.

The question now is, can yields continue to fall and help the NAZ. Or...

Lumber... What a spread

Here is what the one year calendar spread looks like

April 11 2021

30-year at 3.13% and the 15-year at 2.42%

Remember, there is no inflation. LOL!

Rereading Zweigs book today. One of my favorites

April 12 2021

Oh no way? LOL. - World food prices continue to soar, hitting nearly 7-year high

April 14 2021

Why we use systems... as traders. There are so many times that we think a trend has stopped. Overbought, resistance, volume... anyone who’s a real trader will never say that they know when a trend will stop. So you backtest and come up with reasons for why you enter and exit a trade. Then you have to actually love your system and follow it. Bitcoins buy signal started here. It never got a sell signal in to 65k.

The hard part is not coming up with a good system. The hard part is following it. It takes years to do so. This is why I post all this crap for everyone. LOL.

Also I came up with a name for the letter. The unsophisticated trader. Supruzr will get the underlying reason. LOL

Had a signal today will pass it on

The spread between these are huge. That’s usually a short term topping sign. A pull back could happen here

Nothing to be alarmed about for my time frame.

April 15 2021

“And right here let me say one thing: After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It was always my sitting. Got that? My sitting tight!

Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money.”

- Livermore

April 16 2021

April 17 2021

(Forwarded) From Trader Vic I:

We all face a conflict between emotion and reason. Practiced consistently, emotional discipline helps build a sense of confidence and control over your actions. Emotional discipline is the tool that lets you harness your heightened state and choose the best course of action, it provides you with the will to execute your knowledge. Having the will to execute means having the capability or power to carry through on a plan of action designed to achieve a specific goal.

Commitment-a state of mind in which knowledge, motivation, and execution are totally directed toward the same goal.

The key ingredient of being successful is the ability to commit yourself to achieving your goals, which means joining together your conscious and subconcious minds to work for the same ends. Most people have trouble committing themselves because they have conflicting motivations, which arise from conflicting emotions, which arise from conflicting values and beliefs. With this understanding, the formula for positive change seems clear:

Identify limiting and destructive values and beliefs and eliminate them.

Adopt new and life-serving values and beliefs.

Eliminate the subconscious associations which create limiting emotional responses and replace them with new, empowering associations.

Like most formulas, the statement is easy but the application is quite complex.

April 19 2021

April 20 2021

Bitcoin is working on a divergence signal at the moment. Could bounce here. If Bitcoin does not bounce it will be the first sell signal since 9-10k

Red line does not confirm till the close. No sell signal yet. If we close here it’s time to get out

When I try to illustrate how to trade a trend following strategy. This is ideal. I’ll never sell it perfectly at the top because I know enough to know that I don’t know where the top will be. So when we break the short term trend. I’ll sell. That does not mean that we can’t enter again. And still the primary trend is still in tact.

Let’s see how this shakes out in the next couple days

Across the board. The commodities look better than the producers. Stick to strength.

April 21 2021

Oversold signal in the energy sector.

April 22 2021

Corn. Solid move up. See how during the break out the Bollinger band width moved. (Top green indicator) The signifies that the move is real.

Wheat also moving higher.

Oil still has a chance. Today the energy sector got to the bottom of the impliedmove which is usually a good buying zone.

In case anyone’s trading may corn or copper. I’ll be rolling those contracts today

Wheat full on 39 inching it

KC wheat even more so

April 23 2021

IWM russell. Very close to a break out

April 24 2021

April 25 2021

April 26 2021

On Seasonsals

Supruzr posted an interesting chart on ETHBTC. Which made me wonder how ETHBTC performed MOM. April seasonality. Very bullish but the data only goes back to 2017.

April 27 2021

Chart by Supruzr

TSR20 rubber on the SGX exchange is very close to a buy signal

If cocoa gets above yesterday high it’s a buy as well

April 28 2021

Watch the fed meeting today. The set up I’m the price is telling us something about the yield curve. Let’s see if we see some follow through.

April 30 2021

Reversal signal on Bitcoin. Eths been a long (I mentioned before but we have eth futures now) and bitcoin is joining back in the party with extreme volume divergence. Relentless.

We need to close over 60k soon to confirm that we can make another run

Live cattle giving a buy signal right here.

August contract.

I got a question - It was on when I say I’m selling futures or buying futures does it change my crypto currencies (under model weights)

No it does not. These are separate. Similar to having physical gold and silver... if I sell gold in the long term portfolios or the futures portfolio it does not effect my physical holdings.

When it comes to this part the only thing that will change is the allocation.

Right now I’m adding to gold and silver for the first time since March 2020

Which gives us a higher allocation.

Because we are in an inflationary regime, things that pay a yield will be the lowest allocation on my list. This is very long term as opposed to swing trades in futures. Or position trades in the long term portfolio.

Also I’d suggest making something similar for yourselves. It can look totally different. Or similar. But you really want to understand where every new dollar will and can go to.

My main point is the different time lines will always have different trades which is why I really harp on time lines. Bitcoins long term trend for the long term portfolio has a stop around 42k. While a short term trader could have bought bitcoins when it took out the low and reversed higher at 50k last week. A swing trade could get stopped last week and get a long signal in the next week to a couple months. And a investment term holding could hold based on the destruction of the dollar while only taking profits to rebalance in to other things like 1 of the model portfolios or gold or yields.

Comments